FCA incoterms in 2020: How does Free Carrier work?

The FCA Incoterm is one of the 11 terms coined by the ICC to ease international freight trade. The FCA is one of the most popular Incoterms, and it can be used for all forms of transport, including multimodal shipments. This flexible rule is often used by importers who prefer to arrange the main carriage of the goods themselves. Learn everything about the meaning of the FCA Incoterm 2020 and learn how to use FCA prices and shipping terms for your cargo.

Find the best solution for your cargo shipping needs

What is FCA in shipping terms? FCA logistics for international shipping

Under FCA shipping terms, the seller is responsible for delivering the goods to the buyer. Following FCA terms, the goods can be delivered on the seller’s premises or at an agreed location. If the first option is chosen, the seller has to load the goods on the vehicle selected by the buyer, which is often a vehicle from a specific freight forwarder or “carrier”.

Under the Free Carrier Incoterm, the point where the risk of the goods transfers from the seller to the buyer is when the carrier receives the goods. Once the carrier has gotten hold of the goods, the buyer holds all the responsibility.

The FCA Incoterm from 2020 can be used for all types of cargo, although they are preferred for road and sea container shipping.

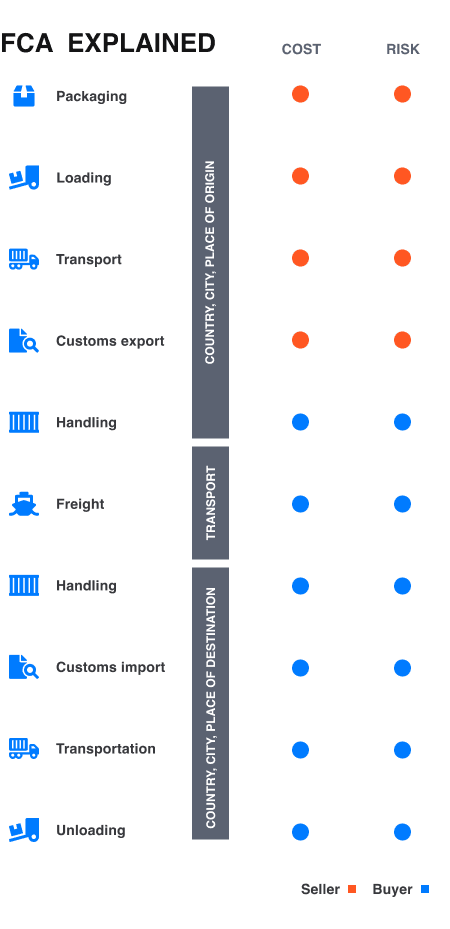

See below an overview of the responsibilities of the buyer and the seller when shipping under the FCA Incoterm.

SHIPPING COSTS

Charges when shipping under the FCA Incoterm

As with all other Incoterms, the Free Carrier Incoterm divides the responsibilities of the seller and the buyer. When you are issued an FCA invoice as a buyer, it is important to know what items are included in that price.

FCA shipping charges for the seller

- Packing and preparing the goods for transport

- Preparing the goods for inspection

- Clearing the goods for export at the country of origin, including taxes, costs and documentation

- If the buyer picks up the goods at the seller’s premises: loading the goods on the selected vehicle

- If the buyer picks up the goods at a designated location: transporting the goods to the designated location.

FCA shipping charges for the buyer

- If the goods are available at the seller’s premises: picking up the goods at the seller’s address already loaded on the selected vehicle

- If the goods are available at the designated location: picking up the goods from the seller’s vehicle

- Freight transport from the country of origin to the country of destination

- Import clearance, duties, taxes and VAT on the country of destination

- Last-mile deliveries and domestic transport

HOW IT WORKS

FCA shipping: seller’s premises vs designated location

There are two main ways to apply the Free Carrier Incoterm to an international trade contract, depending on where the goods will be delivered. There are two possible options: the delivery can happen at the seller’s premises or at a designated location, which should be agreed upon in advance.

The agreement of the pick-up location is essential because the risk of the goods only transfers to the buyer once they get hold of the goods, and the domestic transport costs are only included in the FCA invoice if the sellers make the goods available at a designated location.

- When the seller makes their goods available to the buyer at their premises, FCA terms indicate the seller is responsible for loading the goods on the selected vehicle.

- If the seller makes the goods available at a designated location, like a port, warehouse, terminal or airport, they are not obligated to unload the goods from their vehicles.

FCA shipping: goods available at the seller’s premises

For example, an Irish company sells 100,000 units of merchandise to a US company under the FCA shipping terms. The buyer will pick up the goods at the seller’s premises in Dublin.

- The seller packs the goods and clears them for export in Ireland.

- The buyer books a truck company to get the goods from the seller’s premises to the port of origin.

- The seller gets the goods loaded on the truck at their premises. The risk transfers to the buyer at that moment.

- The buyer pays for the sea transport charges from the port of origin to the port of destination in the US, where they are also responsible for getting the goods cleared for import.

- After the goods are cleared, the buyer can transport them to their address or clients’ addresses in the US.

FCA shipping: goods available at a designated location

Same example as above: an Irish company based in Dublin sells 100,000 units of container merchandise to a US company under the FCA shipping terms. The buyer will pick up the goods at the agreed designated location, in this case, the port of origin in Cork.

- The seller packs the goods and clears them for export in Ireland. They cover domestic transport charges for getting the goods transported from their headquarters in Dublin to the port terminal in Cork.

- Once the goods reach the terminal, the seller’s part is done.

- The buyer unloads the goods from the seller’s vehicles and loads them on the carrier’s vessels.

- The buyer pays for the sea transport charges from the port of origin to the port of destination in the US, where they are also responsible for getting the goods cleared for import.

- After the goods are cleared, the buyer can transport them to their address or clients’ addresses in the US.

CUSTOMS CLEARANCE

FCA customs clearance: FCA terms for import and export

When using the FCA terms for importing or exporting, the seller has to go through the export customs procedures in the country of origin. This means that before they make the goods available for the buyer, they have to be already cleared for export.

FCA customs clearance rules determine that the buyer must manage the import customs procedures at the destination country. They will have to provide the documentation to the domestic port authorities and pay for all applicable permits, duties, and taxes, including VAT.

The fact that the seller is responsible for clearing out the goods for export in the foreign country is the main advantage of the FCA Incoterm over the EXW. With this change, the buyer does not have the risk of potential costs related to cargo that has issues being cleared for export.

CONTAINER SHIPPING

Free Carrier Incoterm for container shipping

Although using the FOB Incoterm is the industry standard for container shipping, the ICC advises using FCA incoterms for these shipments. This is because when using the FOB shipping terms for containers, the seller usually cannot load containerised cargo on the selected vessel. In most cases, the containers are left at a terminal, from where they will be handled by the transport company.

When using Free Carrier Incoterm for container shipping, the risk of the goods transfers to the buyer once the containers are left at the terminal in the country of origin. The seller carries the risk until that very moment, and any problem during loading will be covered by the buyer.

Ship your cargo with a reliable freight forwarder

Join the digital logistics world and access a vast network of vetted freight forwarders. At Eurosender, we collaborate with reliable cargo transport companies and international carriers and will connect you to the provider that best suits your needs. Our team of experts will act as an intermediary on your behalf to organise every detail of the shipping service.

NEED MORE INFORMATION?

FCA logistics, prices and shipping: FAQ

Can the FCA shipping terms be used for land cargo?

Yes, FCA Incoterms is used for any type of cargo, including land cargo. In fact, FCA shipping is especially useful for road freight, for example, within Europe and Asia, because the carrier can use the same truck to get the cargo from the seller and transport it to the final destination.

What is an FCA port?

Sometimes the FCA Incoterm 2020 is referred to as FCA port, as a port is often the designated location where the seller makes the goods available to the buyer.

What are the advantages of using FCA deliveries?

With an FCA delivery, the seller only has to pack the goods and clear them for export. Sellers who have experience with local customs clearance might want to choose the FCA shipping terms when exporting since the responsibility of transport and import clearance is then assigned to the buyer. Thus, the FCA Incoterm is useful for a wholesaler who does not want or can arrange transport.

Does the FCA price include shipping in the country of origin?

It depends on the agreed-upon collection point. If the collection point is the seller’s premises, the seller is only obligated to load the goods on the buyer’s or carrier’s vehicles. If the collection point is a port, airport, depot, or any other location not owned by the seller, the transport from the premises until this location is included in the FCA price.