Delivered Duty Paid: DDP Incoterms for international freight shipping

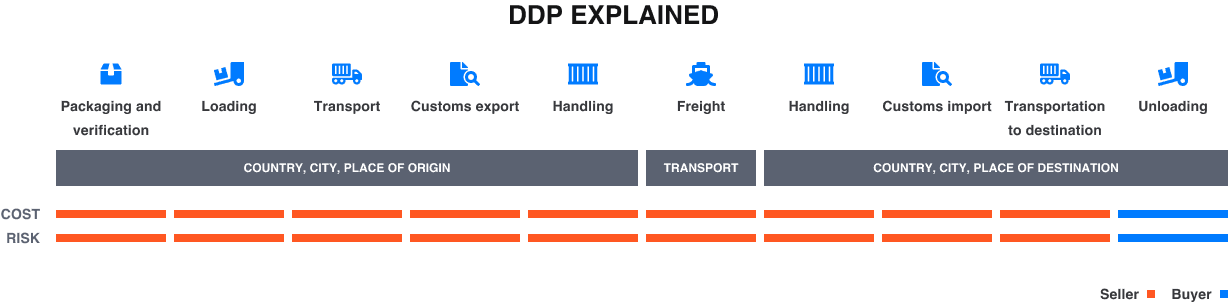

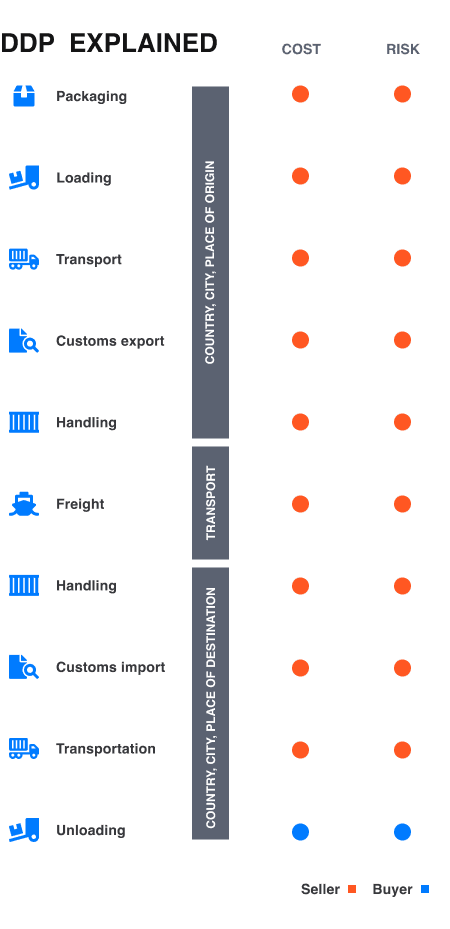

The DDP Incoterm, short for Delivered Duty Paid, is one of the ICC trade terms created to establish responsibilities in an international trade contract. Delivered Duty Paid is an Incoterm that can be used for all modes of transport. This Incoterm gives the most responsibility to the seller, who is responsible for all freight costs and import and export duties until the named destination. Learn more about the meaning of DPP in shipping and get ready to buy and sell cargo internationally effectively.

Find the best solution for your cargo shipping needs

DDP Incoterm from 2020 – DDP shipping terms

The DDP Incoterm 2020 can be used for all modes of transport, including multimodal deliveries when multiple modes of transport are used. The DDP Incoterm establishes the most duties for the seller, who is responsible for delivering the goods to a named destination, which is usually the buyer’s designated address. The risk of the goods transfers to the buyer once the goods are made available at the agreed destination.

The DDP is the only Incoterm where the seller is fully responsible for the import customs clearance procedures in the destination country. In this sense, the DDP shipping terms are the polar opposite of EXW, in which the buyer arranges everything from the export customs clearance to delivery.

When selling goods under DDP, the invoice issued by the seller already includes the transport costs, clearance fees and any potential charge that may come up. Since the buyer is paying for the invoice that includes everything, the seller has little incentive to negotiate the best transport prices, etc., so the costs of shipping with DDP are the highest in the industry.

SHIPPING COSTS

Costs when shipping under DDP

Under the DDP Incoterm, the seller is responsible for all the steps until the cargo is made available at the agreed destination. This means they need to arrange loading, transport, export and import customs clearance, and any other expense incurred during the delivery.

See below the description of the responsibilities of the seller and buyer when shipping under DDP shipping terms.

DDP shipping: costs and responsibilities of the seller

- Packaging the goods properly and preparing them for inspection

- Clearing the goods for export

- Loading them onto the selected vehicle or vessel

- Shipping costs from the place of origin to the designated address

- Import clearance, duties, taxes and VAT at the country of destination

- Final delivery to the named place of destination

DDP shipping: costs and responsibilities of the buyer

- Paying the DDP invoice

- Unloading of the goods at the designated address

Example of DDP shipping term

For example, an Irish company sells 100,000 units of merchandise under DDP shipping terms to a US buyer. The US buyer names the point of delivery to be their depot in inland Virginia.

- The Irish company (seller) packages the items, prepares them for inspection, clears them for export in Ireland and pays a freight forwarder to deliver the goods to the US company’s depot.

- When the goods arrive at the US port or airport, the Irish company pays to unload the goods from the vessel and have them cleared for import in the US.

- The seller also books a local US trucking company to transport the goods to the designated depot.

- The buyer pays to get the goods unloaded from the truck at their depot. The buyer must ensure they have the required equipment for unloading.

DDP CUSTOMS CLEARANCE

DDP terms in export and import: customs clearance

When using DDP terms for import and export, the seller or exporter covers all duties, taxes and clearance charges. The seller is responsible for providing all documentation necessary for the trade, as well as getting the goods ready for inspection at the port of origin and destination.

In practical terms, having the seller deal with the import clearance procedures is one of the reasons why using DDP for international trade may be tricky unless the seller has proven experience exporting on this specific route. Each country has specific rules, and it may be that the seller needs to be a registered business or a resident to be able to complete the import documentation.

Shipping under DDP is very advantageous for domestic transport or shipping within a trade area, such as the EU.

INSURANCE

Shipping insurance under DDP Incoterm

Under the Delivered Duty Paid Incoterm from 2020, neither the seller nor the buyer has an obligation to purchase shipping insurance. However, because the seller carries the risk of the goods until they are ready to be unloaded at the named destination, they often purchase insurance on their end.

Ship your cargo with a reliable freight forwarder

Join the digital logistics world and access a vast network of vetted freight forwarders. At Eurosender, we collaborate with reliable cargo transport companies and international carriers and will connect you to the provider that best suits your needs. Our team of experts will act as an intermediary on your behalf to organise every detail of the shipping service.

Get in touch with an expert

NEED MORE INFORMATION?

FAQ: Meaning and use of the DDP Incoterm in shipping

When to use DDP terms for export or import?

Shipping under DDP has advantages and disadvantages for the seller and the buyer.

When using DDP shipping terms, are the customs clearance fees included?

Yes, Delivered Duty Paid includes customs clearance both in origin and destination. The seller is responsible for clearing the goods at the countries of origin and destination, so they will factor customs duties and VAT taxes into the DDP invoice.

Does the DDP Incoterm include import duty?

When using DDP terms for import or export, duties and taxes are already included. In some cases, such as when importing from the US to the EU under DDP shipping terms, it is possible that the seller also has to cover VAT charges. VAT charges can be between 20 and 30%, depending on the country.

Does DDP mean free shipping?

What the DDP Incoterm means is that the final price for the goods includes all transport and freight shipping costs. Shipping isn’t free; it is embedded in the total cost of the goods.

Is it a good idea to accept DDP delivery terms as a buyer?

The DDP Incoterm can be very convenient for the buyer, as the seller carries most of the responsibilities. Buyers purchasing goods under the DDP delivery term can be sure no extra VAT or import charges will be added to their budget when importing cargo.