Commercial invoice: what is it and why is it needed?

A commercial invoice is a necessary document in international shipping that provides details about the goods being shipped. It serves as proof of sale between the buyer and the seller in an international transaction, as well as a contract between the two parties. Additionally, it helps customs authorities determine which taxes, tariffs, or duties apply to the shipment, and prevent any delays.

Without a commercial invoice, international shipments may be subject to delays, and the goods may not clear customs. In this guide, we will cover everything you need to know about commercial invoices in international shipping, including what information they should contain and how to complete them correctly. We will also discuss common mistakes to avoid and provide tips to help streamline the process.

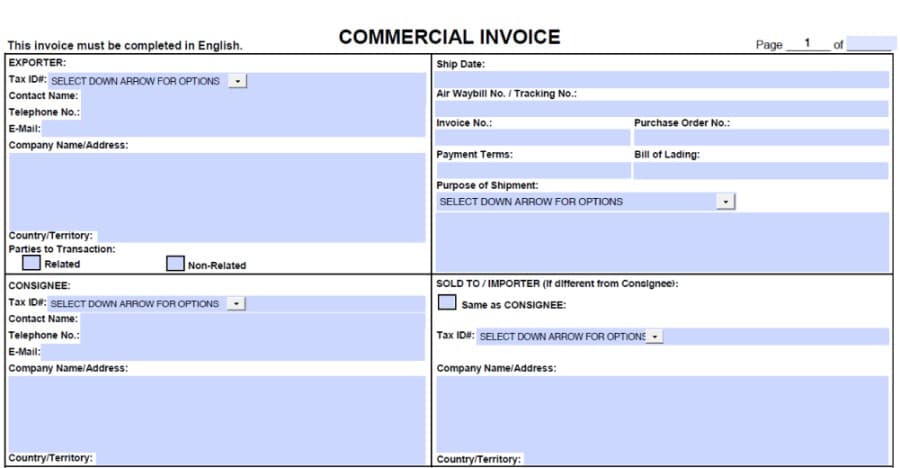

The general structure of a commercial invoice

13 Steps on how to fill out a commercial invoice

1. Shipper/exporter

Provide the shipper/exporter’s complete company name, address, phone number, EORI, and VAT/Tax ID number. Specify if there is any relationship between the parties to the transaction that may influence the declared value of the shipments.

2. Consignee/importer

Provide the consignee/importer’s complete name, address, phone number, EORI, and VAT/Tax ID number.

3. Shipping date and waybill/order number

The waybill/order number is the reference assigned by the carrier to your shipment. These details are important for administrative purposes.

4. Number of packages

Write the number of boxes/pallets/crates in the shipment, as well as their dimensions.

5. Number of units

Indicate the total number of each product you have in your shipment e.g. 30 (hand-made walking sticks) and 120 (garden umbrellas).

6. Weight of each item

Weigh each product and provide the gross and net weight in kilograms.

7. A complete description of the product(s)

Provide a complete description of each item in your shipment, including the product, materials, and intended use. Accurate and detailed descriptions reduce customs delays and help customs officials determine which taxes or duties should be paid.

| Bad description | Good description |

|---|---|

| Clothes | Women’s black chiffon blouse, size M (Zara, model no: 2157/061) |

| Book | Young-adult non-fiction book |

8. Harmonised tariff codes (HS codes)

HS codes play an important role in determining the classification of goods. You will need to provide the HS code of each product you are shipping.

A list of HS codes can be found on any official government website or customs portal. Alternatively, online search tools can provide an HS code when you enter a detailed product description.

9. Country of manufacture/origin

Specify the location where the goods were manufactured, produced, or grown. Please note that the EU is not acceptable as a place of manufacture. Instead, provide the specific country (e.g. Made in Spain) for each item in your international shipment.

10. Value of shipment

It is important to note that even if an item is a sample or return, it still holds a minimum value equivalent to its production costs. Therefore, it is crucial to provide an accurate and true valuation of the product(s). Failure to do so may result in customs delays and penalties.

11. Reason for export/purpose of shipment

State the reason for export on your commercial invoice. Acceptable reasons include fulfilling a sale, returning a product, providing samples, or repairing goods for the recipient. Let’s examine these in more detail:

- Sale: Products that have been sold to a buyer.

- Return: Goods that were previously sent out but are now being returned to their initial point of departure.

- Sample: Items that have been provided at no cost, which are not fit for sale, and are intended to encourage further business between the shipper and the recipient.

- Repair: Goods that are either being dispatched for repair or have already undergone the repair process and are now being shipped back to the customer.

Providing the purpose of shipment is a crucial aspect of your commercial invoice, as it can impact the amount of tax that is applied to your shipment based on its destination. Therefore, it is important to include this information accurately to ensure a smooth and efficient customs clearance process.

12. Terms of sale (Incoterm)

If you have a sales contract, it will specify the Incoterms to be used. If you do not have a sales contract, you must choose one of the applicable Incoterms for land or air shipments. For instance, DAP (Delivered at Place) requires that you, as the shipper, pay for shipping, but the receiver is responsible for taxes and duties.

Read more about Incoterms.

13. Declaration

To finish your commercial invoice, state that you are not transporting any products prohibited by the carrier. Before sending your items, it is recommended that you verify the shipping regulations for each country.

NEED MORE INFORMATION?

FAQ about the commercial invoice and international shipping

Who needs to provide a commercial invoice when shipping?

Businesses shipping goods for commercial reasons across international borders (e.g. outside of the EU) are required to provide a commercial invoice.

Do I need to provide a commercial invoice when shipping with Eurosender?

Yes, if you are sending products internationally for business purposes, you will need to provide a commercial invoice and other relevant shipping documents for the customs authorities.

What is the difference between a commercial invoice and a proforma?

The primary distinction between the two is that a commercial invoice is used for commercial shipments, whereas a proforma invoice is used for personal shipments.

Is a commercial invoice the same as a bill of lading?

No, a commercial invoice is a document that provides details for customs authorities about the goods being shipped, including the type of goods, their value, and the terms of the sale.

How do I attach the commercial invoice to my parcel?

Attach the commercial invoice to the cardboard box along with the shipping label in order for the courier to easily identify and process the shipment. Use a clear packing sleeve or packing tape to firmly attach the commercial invoice to the parcel.