Proforma invoice: what is it and why is it needed?

A proforma invoice is a document required for international shipping that outlines the details of a shipment, including its contents and value. The information contained in the proforma invoice is used by customs authorities for import/export control and to determine duties and taxes that need to be paid before the goods can be released for delivery.

As the shipper, it is your responsibility to provide a complete and accurate proforma invoice. Any false or unclear information can delay the delivery of your parcel. To help you get ready for shipping internationally, i.e. outside of the EU, we have prepared step-by-step instructions on how to complete a proforma invoice.

How do I complete a proforma invoice?

After paying for your Express international shipment, you will receive an “Awaiting customs documentation” email with the link to fill out the proforma invoice. Open this link and fill out the proforma as follows:

1. Shipper details

On the left-hand column, insert the shipper’s name, address and contact details. You will also need to provide their VAT and EORI numbers if they are a business.

2. Receiver details

On the right-hand column, insert the receiver’s name, address and contact details. You will also need to provide their VAT and EORI numbers if they are a business.

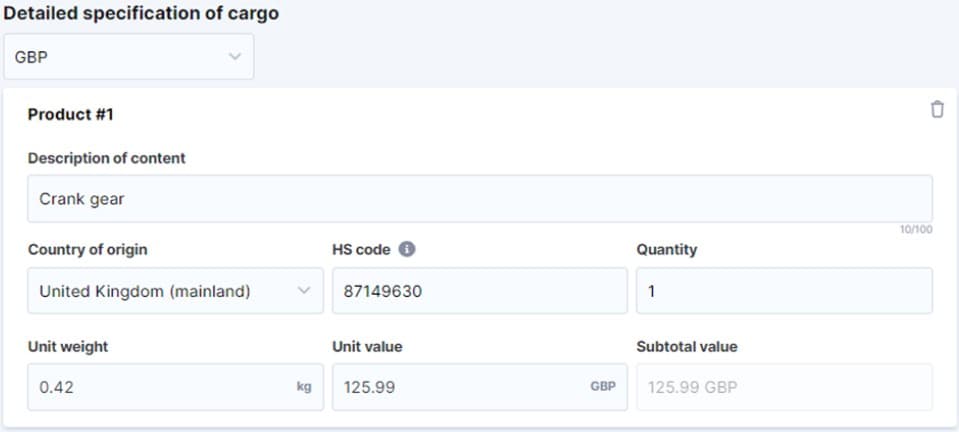

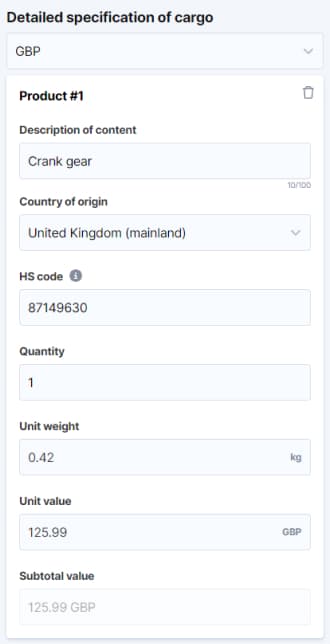

3. Detailed specification of cargo

Using the table provided on the proforma invoice, provide a full description of your shipment. If you are sending different products within one parcel/shipment, fill out the details of each product separately.

4. Description of contents

This is where you should describe the shipment in as much detail as possible. Avoid ambiguous or vague descriptions that may cause delays during customs clearance.

Examples:

| Bad descriptions | Good descriptions |

|---|---|

| Clothes | Women’s short-sleeved t-shirts (100% cotton) |

| Gifts | Red hand-woven bag |

| Samples | 100 cm x 200 cm polyester carpet sample |

| Furniture | Wooden foldable chair |

5. Country of origin

Insert the country of origin of the products. This is where they were originally manufactured – and may differ from the country they are being shipped from.

6. Harmonised system (HS) code

An HS code consists of 6-8 digits and is an international standard used to classify products being shipped. HS codes allow customs authorities to calculate proper taxes and duties as well as apply restrictions if necessary.

You can find the list of HS codes on any official government website or customs portal. Alternatively, you can use online HS code search tools, which will provide a code once you have entered a detailed description of the product.

Example:

If you are shipping women’s short-sleeved t-shirts made of 100% cotton – the HS code will be the following:

- Category: Textiles and Articles (62)

- Subcategory: T-shirts, singlets and other vests (11)

- Material: Cotton (42)

- The HS code: 621142

7. Quantity of items

Insert the quantity of each product you are shipping.

8. Unit weight (kg)

Weigh each product and provide the weight in kilograms.

9. Unit value

State the true value of each individual product, i.e. their market price, along with the currency. If any declared value seems inaccurate, customs officials may ask for evidence that supports your valuation.

After you input the unit weight and value of the items, the system will automatically calculate the subtotal value by multiplying Quantity and Value. Please ensure that all the details are accurate.

10. Upload your invoice

Upload any additional documents you have related to the products being shipped, such as purchase receipts or commercial invoices, etc.

Important: Ensure that all values, including HS codes, package weight, currency, and so on, are identical across all documents.

11. Summary of the information

Your Eurosender order number will be pre-filled in the proforma document, as it was generated specifically for this shipment.

To conclude, insert the reason for export. You can choose between one of the options provided by using the dropdown menu.

Once you are satisfied that all of the information is correct, click the box to confirm. Then, click on next to submit and generate the proforma invoice.

12. Print out the proforma invoice

After submitting your completed proforma invoice, you will receive a “Proforma” email with your document attached. You will need to print the proforma invoice and give it to the driver collecting the shipment. Please note that there is no option for the carrier or Eurosender to print the proforma invoice on your behalf.![]() Download the guide

Download the guide

NEED MORE INFORMATION?

FAQ about the proforma invoice and international shipping

Do I need a proforma invoice for shipping within the EU?

A proforma invoice is generally not required for shipping within the EU since it is a trade-free zone. Although there should be no import/export fees or customs inspections for parcels sent within EU borders, some exceptions apply to EU territories not located on the European continent.

What is the difference between a proforma and a commercial invoice?

The main difference between them is that a proforma is used for private shipments, while a commercial invoice is used for business shipments.

If I’m shipping as a business, do I need to provide a proforma or commercial invoice?

When shipping internationally with Eurosender, you will need to fill out the proforma invoice as a formality regardless of whether you are a private or business shipper. If you have a commercial invoice or additional documentation necessary for the product you are shipping, please submit these along with the proforma.

Can Eurosender fill out my proforma invoice on my behalf?

No, it is the responsibility of the shipper to complete and provide their proforma invoice, as well as any other shipping documentation required.

What happens if I declare lower values on my proforma invoice?

It is forbidden by law to write a lower amount on the proforma or other customs forms in order to avoid paying import fees. Shippers may be prosecuted and have their goods seized if they falsify information on these documents.

How can I print my proforma invoice and shipping label if I don’t have a printer?

If you don’t have a printer at home, we recommend choosing one of the following solutions for printing your proforma invoice and shipping label:

- Send the documents to a family member, friend or neighbour for printing

- Print the documents at your workplace, if possible

- Print the documents at your nearest printing centre