CFR Incoterm 2020: Cost and Freight for sea cargo shipping

The Incoterm CFR from 2020, standing for Cost and Freight, is one of the commercial terms or Incoterms established by the ICC to ease international trade. Used for sea freight, Cost and Freight shipping is a popular option to ship bulk cargo overseas. Read this guide to discover what is the meaning of CFR in shipping and how to transport cargo using the CFR Incoterm.

Find the best solution for your cargo shipping needs.

Cost and Freight Incoterms: CFR definition and use in shipping

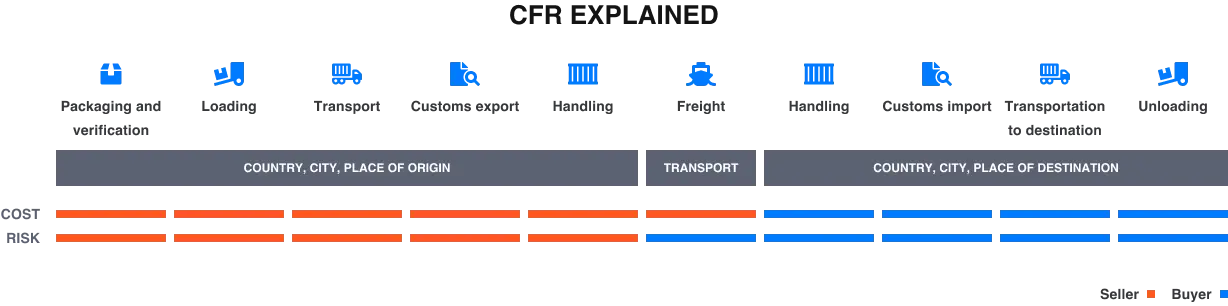

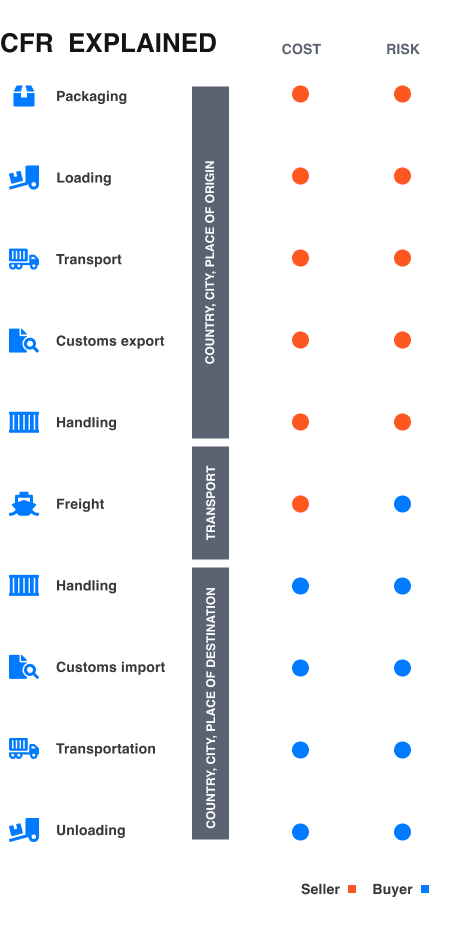

Under the CFR Incoterm, the seller is responsible for arranging and paying for the transport of the goods by sea until they reach the port of destination at the delivery country. Following the delivery term CFR, the seller also must pack the goods and clear them for export. The buyer is responsible for arranging the unloading and domestic transport of the cargo, as well as covering the customs clearance and import duties and taxes in the country of destination.

Although when shipping under the CFR Incoterm, the seller must arrange and pay for the goods’ transportation until the port of destination, the buyer is liable for the goods from the moment they are loaded onto the vessel at the port of origin. Unlike CIF (Cost, Insurance, and Freight), when using the Cost and Freight Incoterm, the seller is not obligated to insure the cargo.

SHIPPING COSTS

Costs and responsibilities when shipping under CFR

When using the CFR Incoterm from 2020 in a contract, the seller and the buyer agree on which costs will be covered for each party. Under the CFR Incoterm, the seller pays the freight costs to the port of destination. Additionally, the seller can agree to cover the unloading of the goods at the port of destination, although it is not traditionally included under Cost and Freight Incoterms.

CFR costs for the seller

- Packaging the goods

- Export clearance and documentation, taxes and fees

- Loading the cargo on the vessel at the port of origin

- Shipping fees until the port of destination

CFR costs for the buyer

- Unloading the cargo at the port of destination

- Import clearance, duties and taxes at the country of destination

- Domestic inland transport to the final place of destination

Example of shipping under CFR Incoterm

An Irish company sells 100,000 units of merchandise under the CFR shipping term to a US company.

- The seller packs, delivers the goods onboard the ship and clears them for export.

- The Irish company arranges transport with a freight forwarder and pays for the shipping until the port of destination in the US.

- Once the goods are loaded on the ship, the risk passes to the US company.

- The US company pays for the import fees and customs. They must also cover the unloading of the goods at the port of destination.

See other Incoterms for international shipping

CFR CUSTOMS CLEARANCE

Who pays for customs clearance in CFR?

When using the CFR terms in export and import, the seller must pay all the export duties and taxes and provide the necessary documentation for customs. The buyer must cover import duties and taxes in the destination country. This way, the final price of a shipment under the CFR Incoterm includes export duties but not import costs for the buyer.

INSURANCE

CFR Incoterms insurance and liability

When using the CFR Incoterm from 2020, the seller is not obligated to add insurance coverage to the goods. That is the main difference between the CFR shipping term and CIF. The seller is only liable for the cargo until it has been loaded on board the vessel at the port or origin. From that moment on, following CFR insurance rules, the buyer assumes all risk. Therefore, the buyer is advised to purchase insurance for the cargo when shipping under the CFR Incoterm.

Ship your cargo with a reliable freight forwarder

Join the world of digital logistics and get access to a vast network of vetted freight forwarders. At Eurosender, we collaborate with reliable cargo transport companies and international carriers and will connect you to the provider that best suits your needs. Our team of experts will act as an intermediary on your behalf to organise every detail of the shipping service.

Get in touch with an expert

NEED MORE INFORMATION?

FAQ: Use of the Cost and Freight Incoterms (CFR) in shipping

What is the meaning of CFR in import?

If you want to import goods using the CFR term, it means that the purchase price you pay for the imported goods includes export clearance, loading and shipping fees to the selected port of destination. As a buyer using the CFR terms in import, you must purchase insurance, cover the unloading costs (unless specified) and pay any import taxes, duties and customs in your country. You are also liable for the cargo from the moment it is loaded on the ship at the port of origin.

Can I use the CFR shipping term for containerised cargo?

Following the update to the CFR Incoterm in 2020, the ICC no longer recommends using the CFR shipping term for containerised cargo. In this case, it is better to use CIP (Carriage and Insurance Paid) Incoterm instead.

What are the advantages of the Cost and Freight Incoterm for the buyer?

Using the CFR shipping term for the buyer means they do not have to deal with any foreign customs agencies or freight forwarders. The additional costs start at the port of destination in the buyer’s country, where they might be familiar with transport costs and formalities. The buyer is also responsible for insuring the cargo, so they can choose the plan that best suits their needs. Additionally, the buyer can sell the cargo during transit. However, because the seller is responsible for arranging the CFR shipping, there is a risk of overcharging.